##Binance Denies Improper Use of $1.8B of Users’ Funds

Visit - https://telegram.me/btctradingclub

Visit - https://cryptosignals.quora.com/

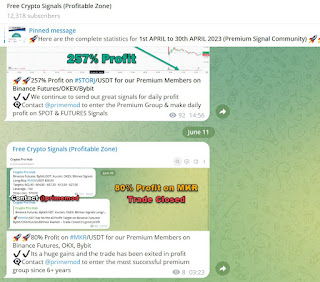

(9% Profit on #FIDA) (10% Profit on #SNX/USDT) (30% Profit on #AGIX) (82% Profit on #FXS/USDT) (10% Profit on #TVK) – Best FREE Crypto Signals groups on Telegram for major exchanges such as Binance, Bittrex, Bitmex, Binance futures, Bybit, Kucoin, CoinDCX, WazirX, Coinswitch,, Kraken, Bitseven, FTX & many other exchanges - then our signals are perfect for making daily profit.

We are SPECIAL as we assist our traders by sending them the EXIT or Closure call on time which makes the trading easier. We have generated consistent profit past few months for Premium Members in crypto trading - All the results has been shared.

Binance was accused of moving almost $2Bn without permission. The exchange denied the rumors. Is it just FUD or damage control?

Binance, the world’s largest cryptocurrency exchange, denied a report published by Forbes titled “Binance’s Asset Shuffling Eerily Similar To Maneuvers By FTX,” which argues that the crypto giant transferred $1.8 billion associated with its users’ funds.

According to Forbes, between August 17 and early December 2022, Binance moved “silently” $1.8 billion deposited “as collateral intended to support its customers’ stablecoins,” leaving many of its users with unbacked funds.

This was despite the company’s claim that it had fully audited its reserves and never touched its clients’ deposits.

What Forbes Says

Forbes alleges that $1.1 billion of the funds extracted from customers in USDC tokens, the stablecoin issued by Circle, were sent to Cumberland/DWR, a Chicago-based high-frequency trading firm. Forbes reports that the company “may have assisted Binance in its efforts to transform the collateral into its own Binance USD (BUSD) stablecoin.”

Forbes also claims that other relevant actors in the crypto ecosystem, such as Amber Group, Sam Bankman-Fried’s Alameda Research, and Justin Sun’s Tron, received hundreds of millions of dollars in funds from Binance.

“According to blockchain data examined by Forbes, from August 17 to early December–about the same time FTX was imploding–holders of more than $1 billion of crypto known as B-peg USDC tokens were left with no collateral for instruments that Binance claimed would be 100% backed by whichever token they were pegged to.”

Forbes suggests that the way Binance manipulated its clients’ funds mimicked the maneuvers employed by FTX before applying for bankruptcy. The US investigators claim that FTX sent money to Alameda Research even though it was prohibited.

The article states that just because Binance is not regulated as a standard financial company, it automatically means its transactions are illegal. However, it makes it easier for regulators to demand that regulated businesses separate themselves from the custodians of their clients’ assets.

Binance Responds to Forbes’ Allegations.

Binance responded to Forbes’ allegations of mishandling user funds, denying any wrongdoing. The company’s spokesperson assured the transactions in question were part of their internal billing processes and did not affect the collateralization of user assets.

“While Binance has previously acknowledged that wallet management processes for Binance-pegged token collateral have not always been flawless, at no time was the collateralization of user assets affected. Processes for managing our collateral wallets have been fixed on a longer-term basis and this is verifiable on-chain.”

Later on, Binance’s CSO, Patrick Hillman, explained that capital movements between wallets were normal and that the exchange does not mix its assets with clients’ funds. He invited interested parties to verify the veracity of their claims in public blockchain records.

Binance’s efforts to counteract the effects of bad publicity are not superficial. The exchange has been involved in several situations that have tarnished its image. From the CEO of FTX accusing the Binance CEO of orchestrating the downfall of his exchange to an uproar caused by the confirmation that, on previous occasions, Binance failed to collateralize its BUSD stablecoin by up to $1 billion.

And beyond that, the stablecoin itself is currently under the regulators’ microscope. Paxos stopped minting it after it was revealed that the SEC was investigating the firm, and US exchanges are already watching their backs, with Coinbase taking the first step and delisting the token.

Comments

Post a Comment