##Former Goldman Exec Says Ethereum ($ETH) Is Safest Bet, but Also Bullish on Some Rivals

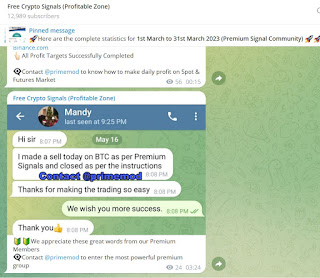

Free Crypto Signals - https://telegram.me/btctradingclub

https://cryptosignals.quora.com/

Daily 4-5 Crypto Signals for major exchanges such as Binance, Kucoin, Binance Futures, Bybit, Coinswitch, CoinDCX, Kraken, WazirX, Bitmex, HitBTC, Bittrex, Bitfinex, BitSeven, Poloniex etc - then our signals are perfect. We do inform about closure of trades - They have been asked to EXIT the trade. The Key to success is here - We provide the entry as well as the EXIT Price. All our coins which we have asked to buy or hold has provided great profit. Enter our Telegram Community and be among the best

Recently, Raoul Pal, a former Goldman Sachs executive, shared his thoughts on the bull case for Ethereum ($ETH) and some of its strongest rivals in the blockchain space.

Prior to founding the macroeconomic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of the finance and business video channel Real Vision, which he co-founded in 2014.

According to a report by The Daily Hodl, during a recent interview with Altcoin Daily, this is what Pal had to say:

“ETH is the money of the internet. And I don’t think it’s going to lose that. But, that doesn’t mean it’s the best performer. Because we’re going to push use cases elsewhere for innovation...

“We’ve got things like Sui coming. Aptos hasn’t been fully utilized yet. We need to see the network effects. Solana, I think they’re aiming for the broadest adoption by making it a consumer-friendly place, to onboard normies. That’s very powerful. If they get that right… and their work with people like Meta and stuff like that – Instagram – is very interesting. That’s super amazing... Polygon, amazing group, what are they doing? They’re onboarding a lot of people. They’ve got a lot of throughput, super interesting. .. Sui hasn’t even come on to the market yet, and that is faster, incredible team, stuff like that, so there’s a lot going on here. But ETH is the easiest way because it’s probably got the least risk.“

On 16 February 2023, Binance Research, the research division of Binance, the largest cryptocurrency exchange by trading volume, released a research report that takes a closer look at Ethereum’s upcoming Shanghai upgrade.

The Beacon Chain introduced staking to Ethereum, but one of its limitations was that validators could deposit ETH to the Beacon Chain, but could not withdraw it. The Shanghai Upgrade, specifically EIP-4895, will change this by allowing validators to withdraw their ETH and any accrued staking rewards.

According to the Binance Research report, which was written by Shivam Sharma, a Macro Researcher at Binance, since the Beacon Chain launched in late 2020, over 16.5 million ETH (over $25 billion as of February 2023) has been staked. Roughly, 520,000 validators have facilitated this staking, with Binance Research naming Lido as the largest player in the market, accounting for around five billion staked ETH and 29.2% of the market. Lido gives users stETH tokens to represent staked ETH on its platform; stETH has largely traded in-line with ETH over the last few months.

The upgrade will introduce two forms of withdrawals: partial withdrawals and full withdrawals. Partial withdrawals refer to withdrawing any earned staking rewards in excess of the initial 32 ETH staked on the Beacon Chain, while full withdrawals refer to the withdrawal of the entire balance.

The Shanghai Upgrade is expected to help those who had previously been hesitant to stake their ETH since withdrawals will eliminate the liquidity risk and uncertainty of an undefined lock-up period. The report says that this could result in a whole bunch of new participants, which could bring a certain amount of buying pressure to ETH, especially if institutional investors can be enticed.

Binance Research also mentions that another significant effect of the Merge was the reduction in ETH supply growth from over 3.5% per year to -0.03%, making ETH deflationary since January 2023. However, it claims the macro environment remains a short-term concern for ETH and the overall crypto space.

Apparently, Ethereum’s DeFi market dominance has decreased from ~96% to ~60% since November 2020, with BNB Chain, Tron, Avalanche, and Solana enjoying significant growth. As for NFTs, Binance Research says that Ethereum remains the top blockchain choice for “most premium collections,” although it does acknowledge that Solana and Polygon have emerged as two potential competitors for Ethereum in the longer term. Polygon has managed to attract Web2 giants, such as Disney and Meta, to NFTs, while Solana has its own vibrant community and remains a great place for newer users/artists to experiment with NFTs.

Comments

Post a Comment