#U.S. SEC Once Again Rejects ARK Invest’s Proposal for a Spot Bitcoin (BTC) ETF

Free Crypto Signals - https://telegram.me/btctradingclub

https://cryptosignals.quora.com/

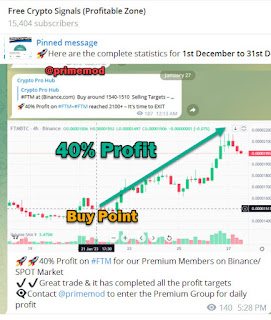

Free Crypto Signals (Profitable zone) provides excellent Crypto trading signals to all Crypto Traders. It has an unique system to capture the Trend which results in huge gains for Crypto Traders. We provide Crypto Signals services on telegram for major exchanges such as Binance, Kucoin, Binance Futures, Bybit, Coinswitch, CoinDCX, Kraken, WazirX, Bitmex, HitBTC, Bittrex, Bitfinex, BitSeven, Poloniex etc - then our signals are perfect. We do inform about closure of trades - They have been asked to EXIT the trade. The Key to success is here - We provide the entry as well as the EXIT Price & All our coins which we have asked to buy or hold has provided great profit. Enter our Telegram Community and be among the best. Apart from Crypto Signals, we do provide completely free Crypto Currency Investment Training from Certified Bitcoin Professional

The U.S. Securities and Exchange Commission (SEC) has turned down another attempt to launch a spot Bitcoin (BTC) exchange-traded fund proposed by Cathie Wood’s ARK Invest and global crypto ETF provider 21Shares.

In a newly issued order, the SEC is rejecting a proposal that would allow the ARK 21Shares Bitcoin ETF to be listed on the Chicago Board Options Exchange’s (CBOE) BZX Exchange.

ARK Invest first sought the SEC’s approval for a spot Bitcoin ETF in June 2021, but the financial watchdog denied the application, citing a lack of proper investor protections.

The firm made another attempt to secure the regulatory agency’s approval in May 2022. In a filing, the CBOE asked the SEC to green-light a proposed rule change that will pave the way for the listing of the investment product.

In a recent order issued on January 26th, the regulator says there was a failure to demonstrate that the proposal is consistent with standards that are meant to prevent fraudulent acts and protect the interest of traders.

The CBOE’s claim that it has a comprehensive surveillance-sharing agreement with a regulated market of significant size to prevent fraudulent and manipulative acts did not persuade the SEC.

“BZX contends that, if approved, the proposed ETP would protect investors and the public interest. However, the Commission must consider these potential benefits in the broader context of whether the proposal meets each of the applicable requirements of the Exchange Act.

Because BZX has not demonstrated that its proposed rule change is designed to prevent fraudulent and manipulative acts and practices, the Commission must disapprove the proposal.”

Comments

Post a Comment