#Banking Giant Goldman Sachs Ranks Bitcoin As World Best Performing Asset

Free Crypto Signals - https://telegram.me/btctradingclub

https://cryptosignals.quora.com/

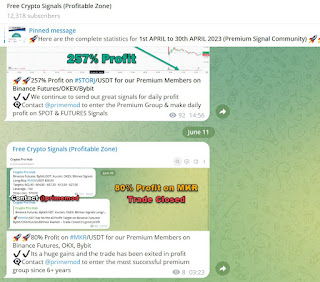

aBitcoin Trading Club provides excellent free Crypto trading signals to all Crypto Traders. It has an unique system to capture the Trend which results in huge gains for Crypto Traders. We provide Crypto Signals services on telegram for major exchanges such as Binance, Kucoin, Binance Futures, Bybit, Coinswitch, CoinDCX, Kraken, WazirX, Bitmex, HitBTC, Bittrex, Bitfinex, BitSeven, Poloniex etc - then our signals are perfect. We do inform about closure of trades - They have been asked to EXIT the trade. The Key to success is here - We provide the entry as well as the EXIT Price. All our coins which we have asked to buy or hold has provided great profit. Enter our Telegram Community and be among the best & Apart from Crypto Signals, we do provide completely free CryptoCurrency Investment Training from Certified Bitcoin Professional

According to Goldman Sachs, Bitcoin has outperformed its cryptocurrency pairs and those major financial institutions of the traditional market with a risk-adjusted return (Sharpe ratio) of 3.1. The Sharpe Ratio is used to measure market volatility-adjusted performance; the higher the ratio, the better the investment, currency, or stock in terms of risk-adjusted returns.

Bitcoin Takes The Lead In Broad Market Recovery

On smaller timeframes, Bitcoin continues its quest to regain lost territory. Slowly but steadily, Bitcoin is attempting to break above the resistance level of $23,800. Bitcoin appears to have a healthy pullback below the resistance line in search of bullish momentum.

Despite the recent crisis of not only the cryptocurrency market with the collapse of FTX and the world economy in free fall, bringing consequences for investors and institutions, the market has also noted the comeback of market makers on cryptocurrency exchanges.

In contrast with Goldman Sachs’ report, according to an annual report by CoinGecko, Bitcoin is the worst-performing asset among the major currencies, with a significant decline of 64%. CoinGecko also noted that since January 2022, the trading volume in the spot market has decreased by 67%.

The new year for Bitcoin and the market started positively, with $200 billion bulking the volume and volatility sheets, according to CoinMarketCap data.

Bitcoin’s year-to-date solid rally has shifted market sentiment. Analysts seem bullish in the short term, expecting the cryptocurrency to increase to as much as $30,000. However, in the long term, economist Lyn Alden said that Bitcoin could be in “considerable danger” in the second quarter of 2023 as liquidity risks increase.

As the price of Bitcoin consolidates below the resistance zone, the cryptocurrency is looking for a trendline break to position itself above the $24,500 level, representing its next obstacle.

The rising 20-day moving average at $20,700 and the Relative Strength Index (RSI) in the overbought zone near 80 suggest that BTC’s bullish trend line can continue and conquer new regions.

Conversely, bears are ready to stall the Bitcoin price action to the upside and turn the momentum and direction of the market, but bulls seem unwilling to surrender. Speculation is on the rise with no certainties in the market and the upcoming Federal Open Market Committee (FOMC) meetings.

Comments

Post a Comment